Accumulated depreciation calculator

Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years Alternatively accumulated depreciation can also be calculated by taking the sum of all historical depreciation expense incurred to date assuming the depreciation schedule is readily available. Its important to determine the salvage value of the asset youre evaluating to calculate the total accumulated depreciation when using the straight-line method.

Accumulated Depreciation Definition Formula Calculation

25000 7500 17500.

. Accumulated Depreciation Formula The calculation is done by adding the depreciation expense charged during the current period to the depreciation at the beginning of the period while deducting the depreciation expense for a disposed asset. Ad Do Your Investments Align with Your Goals. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved. If you want to assume a higher rate of depreciation you can multiply by two. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

Let us take a closer look at how we calculate depreciation for example in Year 2. First one can choose the straight line method of depreciation. First enter the basis of an asset and then enter the business-use percentage.

The accumulated depreciation for Year 2 will be. Calculating Accumulated Depreciation will sometimes glitch and take you a long time to try different solutions. Utilize our Depreciation Calculator below to find the annual allowable Depreciation for your real estate investment property as well as the Accumulated Depreciation of the property over the course of ownership.

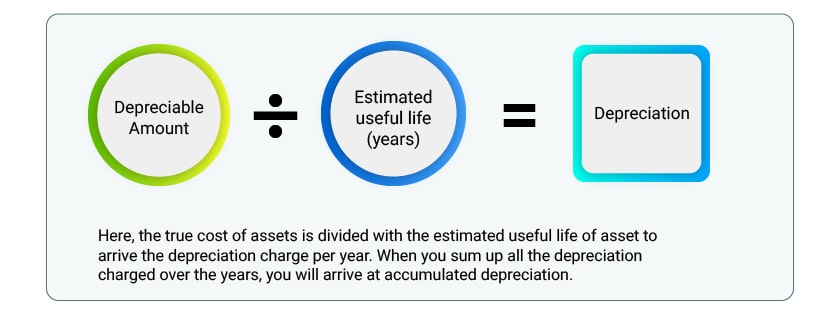

And then divided by the number of the estimated useful life of an asset. On December 31 2017 what is the balance of the accumulated depreciation account. How to Calculate Accumulated Depreciation.

The calculator allows you to use Straight Line Method Declining Balance Method Sum of the Years Digits Method and Reducing Balance Method to calculate depreciation expense. How Does Accumulated Depreciation Calculator Work. It is the cost of the building minus the salvage value.

R230 000 cost price R46 000 depreciation written off to date R184 000 real value x 20 percentage R36 800 depreciation for year 2. If the building cost 400000 and the salvage value is 25000 the depreciable base is 375000. The depreciation expense is debited and the accumulated depreciation value is credited.

100000 20000 8 10000 in depreciation expense per year Download the Free Template Enter your name and email in the form below and download the free template now. Here are the steps for how to calculate accumulated depreciation using the primary method. Find a Dedicated Financial Advisor Now.

Furthermore you can find the Troubleshooting Login Issues section which can answer your unresolved. With this method depreciation is calculated equally each year during the useful life of the asset. In addition to Capital Gains Tax Accumulated Depreciation Recapture tax is also deferred with a 1031 Exchange.

LoginAsk is here to help you access Accumulated Depreciation Calculator quickly and handle each specific case you encounter. Accumulated depreciation is calculated by subtracting the estimated scrapsalvage value at the end of its useful life from the initial cost of an asset. How do you calculate accumulated depreciation using the reducing balance method.

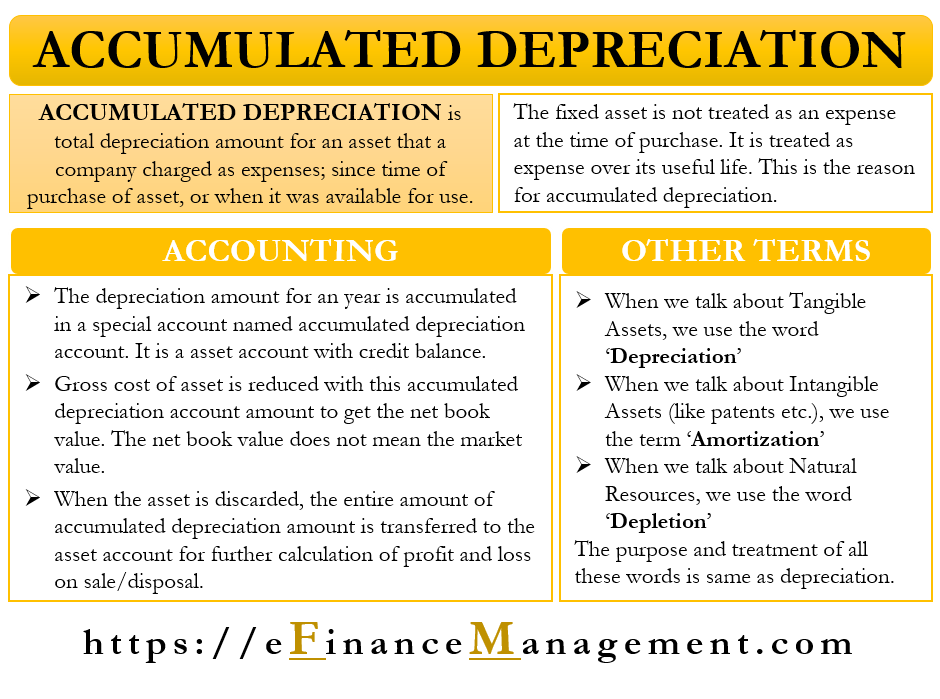

In this article we discuss what accumulated depreciation is. Accumulated depreciation is the total amount an asset has depreciated over its lifespan. The simple formula for how to find accumulated depreciation is.

Total yearly depreciation Depreciation factor x 1 Lifespan of asset x Remaining value To calculate this value on a monthly basis divide the result by 12. Cost x depreciation rate 12 months x months of ownership depreciation. Total Depreciation Starting Cost Salvage Value Every subsequent period the depreciation for an asset gets added to the accumulated depreciation balance.

This simple depreciation calculator helps in calculating depreciation of an asset over a specified number of years using different depreciation methods. R46 000 depreciation Year 1 R36 800 depreciation Year 2. Original cost depreciation to date carrying amount.

How do you calculate accumulated depreciation on a building. Accumulated depreciation is used to calculate an assets net book value which is the value of an asset carried on the balance sheet. LoginAsk is here to help you access Calculating Accumulated Depreciation quickly and handle each specific case you encounter.

Accumulated Depreciation Calculator will sometimes glitch and take you a long time to try different solutions. Subtract salvage value from the original cost. Net Fixed Assets Calculator.

This value is the amount you might expect. Non-ACRS Rules Introduces Basic Concepts of Depreciation. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

An assets carrying value on the balance sheet is the difference between its purchase price. Accumulated depreciation is calculated by subtracting the estimated scrapsalvage value at the end of its useful life from the initial cost of an assetAnd then divided by the number of the estimated useful life of an asset. Accumulated depreciation Depreciation expense Depreciated amount Depreciation expense in this formula is the expense that the company have made in the period.

By Gary Jeffrey - Updated January 26 2022. It provides a couple different methods of depreciation. The MARCS depreciation calculator creates a depreciation schedule showing the depreciation percentage rate the depreciation expense for the year the accumulated depreciation the book value at the end of the year and the depreciation method used in calculating.

You can use the following basic declining balance formula to calculate accumulated depreciation for years. 25000 x 40 12 x 9 7500. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life.

The figure is usually recorded as a single-line entry on a companys balance sheet. The formula for net book value is cost an asset minus.

Accumulated Depreciation Calculator Download Free Excel Template

Depreciation Formula Calculate Depreciation Expense

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Depreciation Calculator

Depreciation Calculator Property Car Nerd Counter

Free Macrs Depreciation Calculator For Excel

Depreciation Calculator Depreciation Of An Asset Car Property

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Definition How It Works Calculation Tally

Double Declining Balance Depreciation Calculator

1 Free Straight Line Depreciation Calculator Embroker

What Is Accumulated Depreciation How It Works And Why You Need It

Depreciation Formula Examples With Excel Template

Reducing Balance Depreciation Calculator Double Entry Bookkeeping

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Meaning Accounting And More